Associated Press - News Source Context (Click to view Full Report)

Information for Associated Press:

MBFC: Left-Center - Credibility: High - Factual Reporting: High - United States of America

Wikipedia about this sourceSearch topics on Ground.News

https://apnews.com/article/harris-walz-nevada-trump-las-vegas-ac21118dbb24290e46d32ad9669507d4

I’d rather not further cement tips as a fundamental part of our economic system. It’s gotten so stupid to the point where you get asked for a tip before any service has even occurred and then the “service” is often just counter service which used to not be tipped. By not taxing this income, you’re encouraging more income to be paid through tips to avoid taxes. When you’re making all these little exemptions and special cases, maybe it’s time to rethink the fundamental system so that it works better as a base case rather than having all these poorly-applied bandaids.

This will be the gateway to removing tipped minimum wage and eventually minimum wage. People often forget it is not just the employee that pays taxes on tips, but also the employer. This will also hurt an already struggling SSI system. I’d really like to see a detailed breakdown of a 10 year outlook on this plan.

Anything to not pay people a living wage.

Big difference is she is likely serious. Im not sure how I feel. These are not the highest paid things but I hate encouraging tips over regular reliable pay.

Lol is this your first American election?

Cause we’re in the phase where all of the candidates blatantly lie to us and tell what we want to hear in order to secure our votes.

Remember when Obama was going to codify Roe v Wade? Or when Trump was going to build a wall and make Mexico pay for it?

those two things are not remotely comparable. obama said he would sign the freedom of choice act which never went to his desk:

"The bills were referred to the Judiciary Committees of the respective Houses. Neither bill received further action in the 108th Congress. The bills were reintroduced on April 19 2007 in the 110th Congress (H.R. 1964/S. 1173), but, like their predecessors, were referred to committee without further action. "

making mexico pay for united states infrastructure is something that could never happen unless we went to war with them. Its a blatant lie from the get go.

As far as taxing tips its about intent. Harris would do it the same as obama would sign the freedom of choice but she is not likely to put all resources to get congress to change the tax code in that way. so she gets a bill she can sign. trump on the other hand is just saying something he thinks people want to hear and would not sign a bill with it in there if it had lets say raised corporate taxes or such.

Good. Taxing tips is bullshit. Even 45 can be accidentally right once in a while. Do Tax on Wall Street Speculation instead.

I would be thrilled if Harris announced taxes on Wall Street shenanigans.

But I highly doubt it

Why is it bullshit? Just because your income comes from clients instead of your boss doesn’t mean it’s not income.

Hell, the US became the US because of the “no taxation without representation” thing, should people who work for tip not be eligible to vote?

Because employers use tips as a reason to pay workers less, even less than minimum wage. It’s a tax on the lower working class. Meanwhile executives like Bezos pay almost zero taxes.

So why choose the wrong solution then? Tax billionaires fairly. Don’t arbitrarily make the waiter not pay taxes but the cook in the back has to? That’s not equal, that’s not fair.

I think tips in general are bullshit and the real answer is to raise minimum wage much higher, so it keeps up with worker productivity. I would prefer that, and to do away with tipping culture entirely. However, passing a tax relief thing is always much easier goal in the US than raising minimum wage, so I’m not letting an ideal internet reply guy solution get in the way of something that actually helps workers. As for it not being fair to the cooks in the back, different jobs pay differently. And believe it or not, some wait staff do share tips with the cooks.

Ok but you said so yourself, it’s work being paid, it’s earnings, are you saying people shouldn’t pay taxes on their earnings?

They will still pay income taxes, just not on the tips portion. This is not at all different than the tiered taxes we already have.

It is different though… At the moment they’re paying on all their income based on tax brackets, with the current they’ll only pay on the regular salary part.

I worked for tip for over a decade, it would have meant not paying taxes on about half my earnings, with tax brackets that would have meant (where I’m at) 3500$ in taxes instead of 13000$ because two thirds of the first half would have been under the minimum taxable amount.

Tips aren’t a gift, it’s salary that comes from customers in exchange for services. You’re creating two classes of lower income citizens if you say that some people don’t have to pay taxes on what might be the majority of their income while the rest pays taxes on all their income.

It’s a bad solution.

This doesn’t sound like a good idea at all. If a person relies on tips for a livable wage, it should be taxed. If you work for tips, it’s taxable income.

Echoing the other comment, tips shouldn’t be the main source of income at a job, so they shouldn’t incur taxes.

No one should be working for tips as their primary income anyway. Pay people a living wage.

I intentionally go to support restaurants where I know they pay their employees a living wage.

This sounds like a reason for companies to rely even more on tipping to compensate their workers… How about instead we make the companies pay the taxes on worker income earned through tipping? Then we can finally do away this ludicrous system we’re all pressured to abide by.

Bingo, if they don’t have to report tips every employer is going to say minimums and say they must be lying if it’s more or less.

Wow I actually really like that idea. I don’t think I would’ve ever come up with it myself. It’d be cool to have a candidate platform made up of the best crowdsourced policy ideas.

Cool. Now let service workers get paid a living wage. Then set the minimum wage to a calculated value based on the rate of inflation and regional cost of living, instead of the idiotic fixed value system. $15/hr is at least 10 years too late.

But that would leave the elites with less money to be trickle down to the economy. Don’t you see the flaws in your proposal?

If this was a “Trump idea”, why didn’t he do it while president?

He was too busy showing everybody he was a president.

Meeting with world leaders and shaking hands.

I’m sure in his lifespan he has shaken hands fir as long as I have masturburbated with my hands.

He got paid 40$ and a meal at McDonald’s

Just one of the many hundreds of things he talked about doing and then never brought up again.

“She stole my idea!”

“Even a broken clock is right twice a day, we’re still waiting for your second time…”

Twitter and reddit are on fire with indignation that Harris DARE consider even one of their high priest’s ideas viable.

The increase of the minimum wage seems more interesting.

Why don’t they just fix the minimum wage problems and stop allowing tipped jobs to have a lower minimum wage. Also stop letting million plus “charity” organizations employ disabled workers at $0.25. ( Goodwill is a scam)

Yeah why don’t they just fix it?

Looks like many haven’t read the article before commenting. While both candidates have a proposal about the same topic, the methodology of implementing this seems to differ greatly.

The reaction in the comments appears to reflect more of the potential outcome of the Trump plan, though the Trump plan seems to mainly be some cobbled together bits of some other Republican proposals.

From the article, the Harris plan goes along with a minimum wage increase and an income cap so higher wage workers can’t collect tax free “tips” in lieu of taxable income.

I also looked up some implications of elimination of taxed tips and found this article that goes into some numbers and shows how raising the standard deduction to make more workers, not just tipped workers, exempt from income tax and benefit many more people. I thought that was interesting and provided more seemingly useful info than either candidates’ campaign promises.

So the title is misleading?

It’s just a title, it says what the article is about, but it can’t say everything. But when everyone comments based on the title and not the article, we risk creating misinformation.

Trump and Harris can both say we should not tax tips, but if that’s the end of the story from Trump, but it’s part of a multi-pronged approach, that’s what we need to be sharing and commenting on.

Everyone’s points about tipped jobs being exploitative are correct, but that isn’t what the article is about. If we just take it as Harris and Trump both want to do the same thing, that’s a half truth, and that is what many of these comments perpetuate. Both sides or this are not the same, and it does a disservice to us all to treat it as such.

Having a more descriptive title can help, like if it said “Harris presents competing plan for removing tax on tips,” but it is somewhat redundant as they wrote the entire rest of the article about it. I feel this is why we include the article with the post, and not just the title, no? 😉

I feel I’m sounding a bit harsh, which isn’t my intent, but it irks me when I can go through a comment section and see just about everyone has missed the point.

Ok. Got it. Sounds like a misleading title.

The solution would be to increase the lowest tax bracket then.

That’s another fine suggestion.

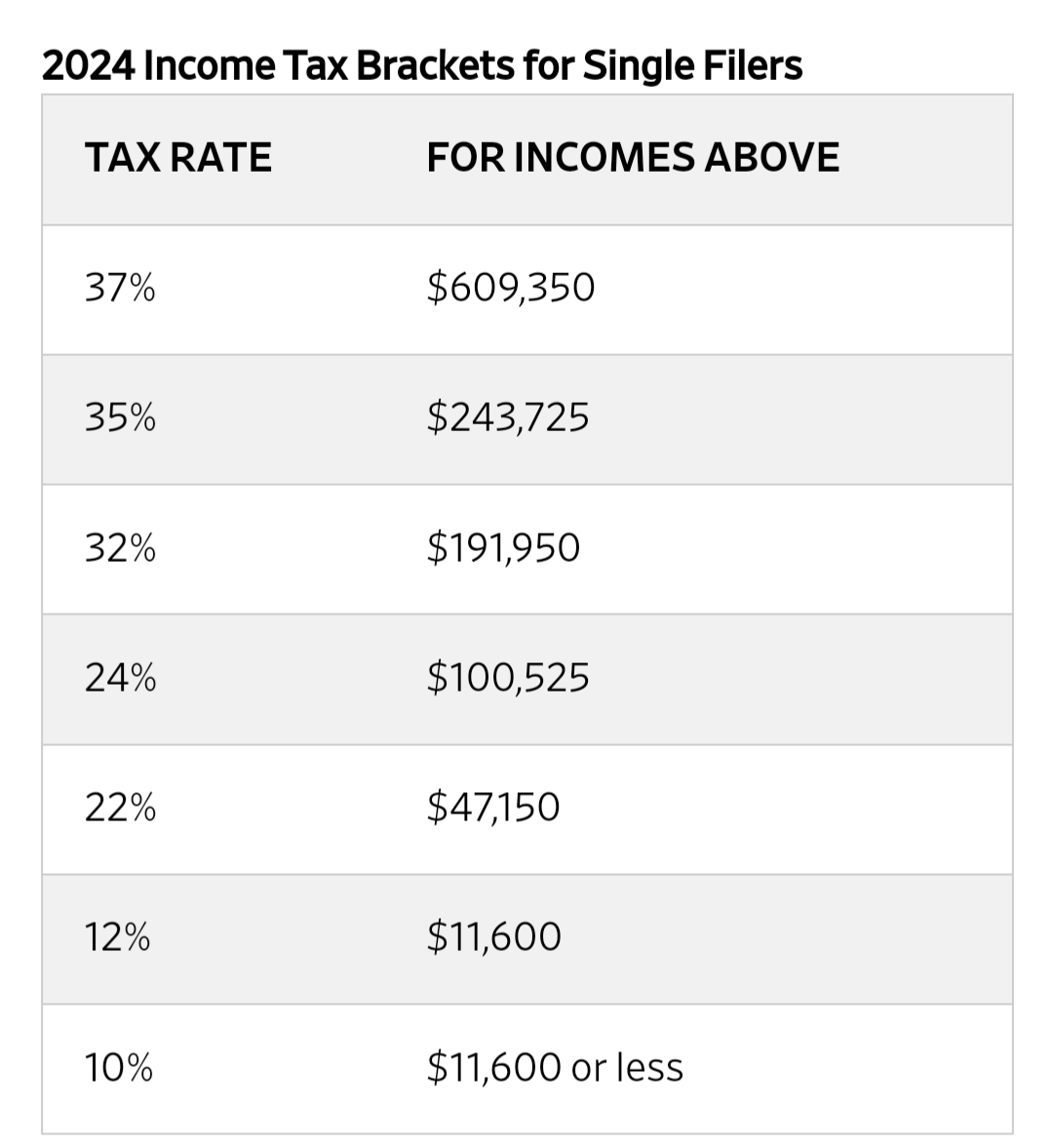

The numbers didn’t really look in line for today’s incomes, and from what I can tell from this, tax brackets for anything but the highest earners haven’t changed other than an inflation adjustment since the 80s.

The us also has a $14,600 standard deduction that effectively adds a 0% bracket and increases the lower thresholds by that amount (people in the higher thresholds would probably itemize, decreasing their effective tax even further).

The IRS does index the tax brackets for inflation.

Also, that table does not include state taxes.

There is a lot more to it than the table. I think it was OP’s article mentioned that there were bills circulating to eliminate the state income tax on tips as well as just the federal.

I mentioned some of the other taxes in my other replies a bit, but other than paying taxes, I’m not much of an expert. Plus if most people couldn’t be bothered to read the original article, I’m not going to look up a bunch more data they won’t read. 😁

Our taxes could be worse, but they could also be much better. I don’t know if these tip tax plans will do much, as it’s <3% of people making tipped income according to the article if I’m remembering it right from yesterday. Something that would help the bottom 50% of earners seems like it would be worth the effort instead, instead of cementing tip culture as a substitute for fair wages, but that’s just my opinion.

I’ve only ever lived in states that don’t have state taxes, only federal. That said every place I worked when I was younger had people just lying about their tips by claiming they only made tips that came from cards and pocketed all their tips from cash and never reported it. As cash has slowly disappeared more and more I’m sure that is dying off but tips were never a good thing for society. They are “politically correct” bribes. Then when companies realize customers will bribe their workers to be more helpful they got greedy and started taking those bribes. To which we made laws about stealing their bribes, so they paid politicians to make minimum wage separate for commonly bribed positions, effectively making it legal to steal bribes from their workers.

Making a portion of jobs qualify to not be taxable in parts of their income and not others regardless of tax brackets would be unresponsible. We are complicating a system that doesn’t need to be more complicated, and all that does is make more room for loopholes and exploitation (whether it be if the worker or of the taxes that should have been paid).

My experience talking with waitstaff friends mirrors yours.

They all swear they’re getting the better end of the deal because they have good nights, but there’s gotta be dead nights where they make nothing, and I can’t imagine disability or unemployment is good when your wage is $2/hr.

To me it’s passing the cost of labor onto customers in a less than transparent manner, and with wage theft by employers seeming to be a problem with restaurant staff, I don’t know how you can prove stolen cash tips.

It varies, usually the ones I knew would make more money than those working back of house without an issue. Back of house would get paid say $10 an hour and work a 9 hour shift. Front would come in for 6 hours and leave with ~$150. Creating a natural divide between the two.

Wish my wages were taxed at those brackets

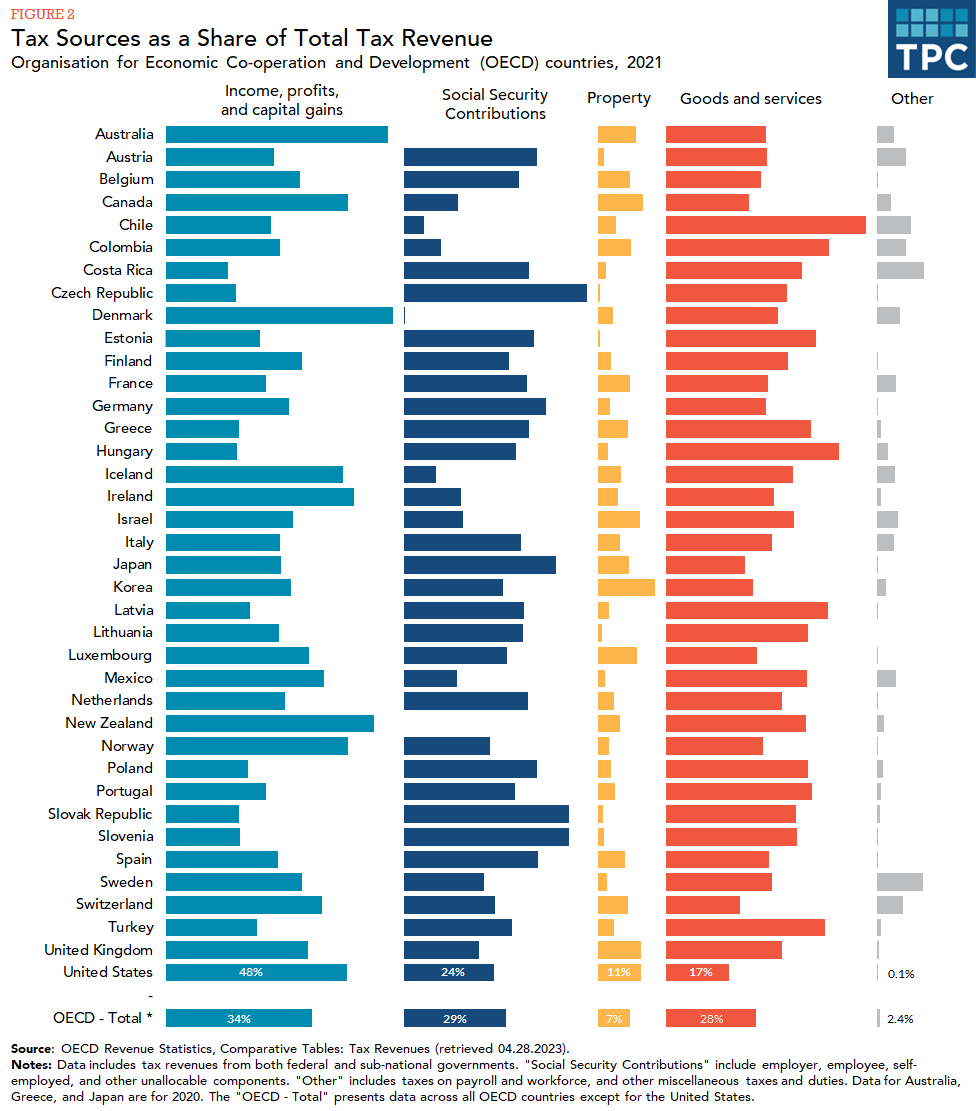

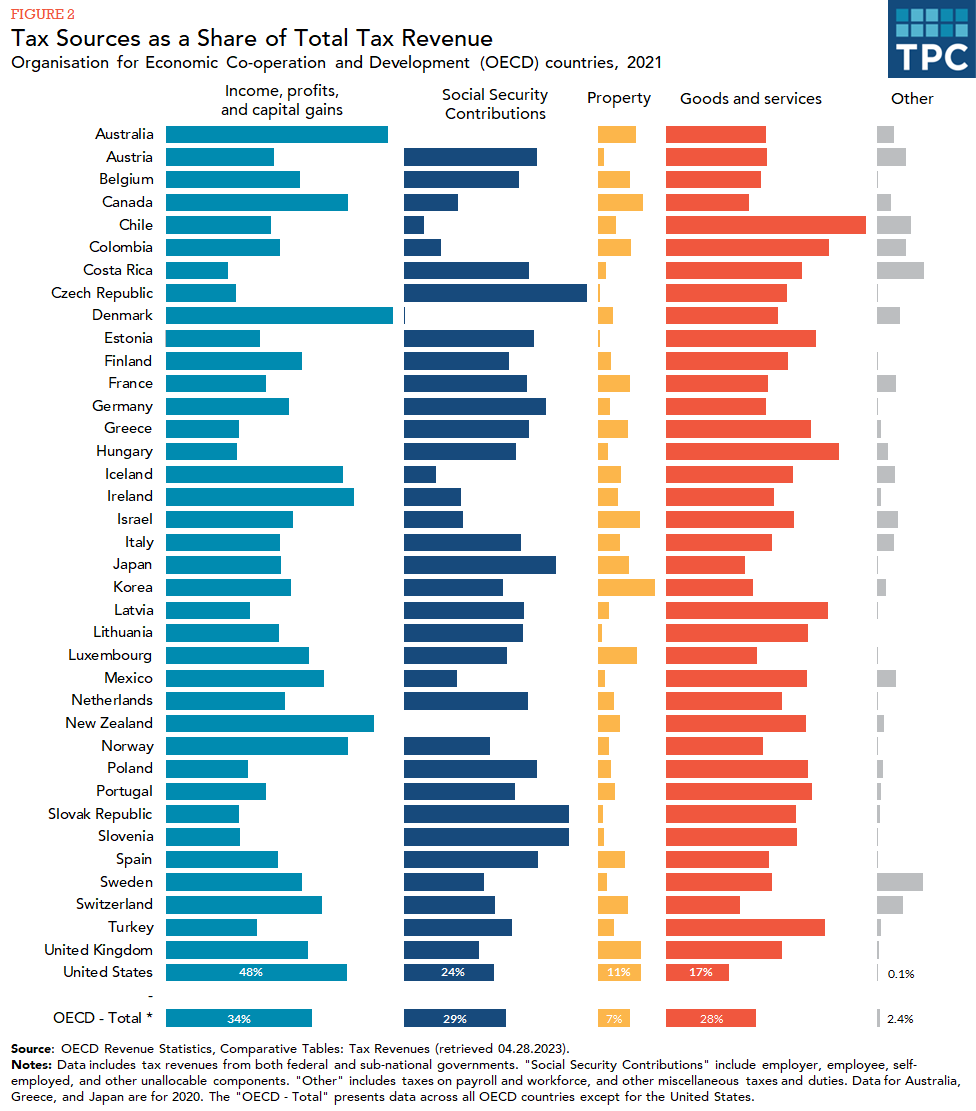

I’ll guess if you’re non-US, you’re also getting things for your taxes such as healthcare and other services. For us, it’s essentially a la carte pricing, so for many of these people in the lower tax brackets, healthcare is much more than taxes.

The bottom 50% of earners pay about $700/yr in federal tax. State and local taxes, property tax, school tax, and sales tax on top of that. “Average” income tax is $15,000, only due to wealth disparity. The bottom 50% pay less than 2.5% of all income tax.

Average healthcare cost is around $14,000/yr, so even for solidly middle-class people, healthcare costs are the same or higher than paid taxes, so that is probably much closer to, if not more than you may be paying.

Paying tax is a civic responsibility. The real pain comes from not feeling like you get what you pay for. I’ve no issue with coughing up some cash for safe roads and food inspectors, but when we have bridges collapsing and healthcare isn’t considered a human right, it makes for some discontentment.

Before any taxes are applied, we pay 13,08% for social security. Then taxes are applied according to following brackets:

Wow, that chart does look crazy high in comparison.

I always think VAT looks wildly expensive as well.

I found 2 more charts and each country looks to have fairly different ways of taxing people, making it hard to see who’s getting the best and worst deals. Especially as the taxes go to different things.

This is just federal income tax and doesn’t count tax contributions towards medicare and social security (which is capped after a certain level, so someone making $1 million a year pays the same toward social security as someone making the cap which is currently around $160k). It also doesn’t count state income taxes.

That’s nice. But she needs to get on with raising the minimum wage to a living wage and pegging it to inflation/COL.

Anything except exactly that is a waste of time and resources. A PR stunt.

The difference is, I believe her.

" . . . echoing trump vow"

FY AP.